To be precise, this one thing scored me the following (all FREE!):

– 3 return tickets on British Airways from London (LHR) to Edinburgh (EDI)- or it can be counted as 6 tickets LHR-EDI-LHR.

– 2 return tickets on Jet Airways from Coimbatore (CJB) to Chennai (MAA) or 4 tickets CJB-MAA-CJB.

– 1 return ticket on Jet Airways from Indore (IDR) to Goa (GOI) or 2 tickets IDR-GOI-IDR.

– 4 nights in a Taj hotel at Goa…with breakfast for our family of 3.

– 1 night at a Ramada property in Bangalore…with breakfast again.

– So many airport lounge access, I forgot the count.

– Discounts at restaurants and stores – online as well as offline.

– and much more…

When I mentioned this to my friends and acquaintances, they all were incredulous and wanted to know how I bagged these deals and could they get them too? Hence this post to explain the modus operandi of getting free flights, hotel stays and more.

So what it that one thing? Okay, drumroll please…that thing is a

Travel Credit Card!

Now, don’t roll your eyes. We are not talking about just any credit card, but a travel credit card. There are two types of travel credit cards – a co-branded card and a brand agnostic card. Co-branded cards like Air India-SBI or JetPrivilege-HDFC have one-to-one tie-ups between brands e.g. the issuing bank (SBI) and the airline (Air India). On the other hand, a brand agnostic card (it will not be categorised as such and will have different names) has relations with multiple airlines, hotels, airport lounges etc. In most cases, these are NOT basic credit cards, but higher level credit cards which may have some eligibility criteria that need to be fulfilled by you. These criteria are usually based on your annual earnings and credit rating.

So how does this travel credit card work?

You first apply and get a travel credit card from one of the reputed banks. You will also need to be a frequent flyer of your favourite airline/s and loyalty member of hotel chain/s. (Simply apply online to obtain FREE membership to any airline frequent flyer and hotel loyalty program)

When you receive the credit card, you get joining bonus miles and then bonus miles on renewal every year. Every time you spend and make your payment through this travel credit card, you earn miles or points. You will notice that the difference between various levels of credit cards (Platinum etc) is the rate of earning. Higher the card type, faster is the rate of earning miles and points. After you have accumulated these miles / points, you can contact the helpdesk (usually an exclusive helpdesk) and request to transfer these miles or points for proportionate number of miles on your airline frequent flyer or hotel loyalty program. When you are ready for that vacation, login to the airline’s / hotel’s website and redeem them for free flights and free stays.

Allow me to explain with an example.

I have a Citibank Premier Miles Credit Card, for which I pay a nominal Rs 3000 per year. On joining I got 20,000 miles (that was way back in 2007, now it is 10,000). I earn 10 miles for every Rs 100 I spend on air ticket as well as other special partners and 4 miles for every Rs 100 on other expenses. Sometimes, Citibank runs promotions where I earn double or more miles. I am also a frequent flyer on Jet Airways, Singapore Airlines, British Airways etc and am a member of loyalty programs of Taj Inner Circle, Hilton HHonors, Club Carlson (Radisson, Park Plaza & more) etc. After I have accumulated a good number of points, I transfer them to the program/s of my choice. It takes them a week or so to transfer these points. I then log into my account for that airline / hotel and redeem the points. So, if you have planned your vacation to say, Singapore, check how many miles are required for a return / one-way ticket by the airline which has a relation with the credit card. Then, check the hotel redemption rates as well. After comparison, transfer and redeem the points as required.

You can transfer all miles / points or a part of it to one or multiple loyalty accounts. But, again don’t spread yourself so thin that these points become useless. In my eBook ‘i.Wander: The Definitive Guide to Travel Hacking’, I have explained all these in detail with calculations and examples.

Other Benefits of a Travel Credit Card

Besides free flights and free hotel stays, these travel credit cards also offer the following benefits:

– Upgrades. Why not travel in style and get that business class upgrade? If you have the points / miles, you can redeem them for a higher class of travel in the airline and also get a higher room upgrade in hotels.

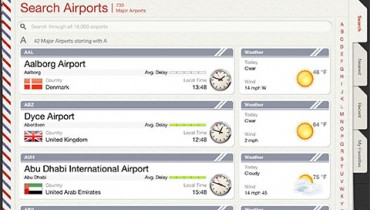

– Lounge Access at Airports. You get free access to lounges at the airports. Most of them are located at the airside (after security check). They offer comfortable seating, computers and / or tablets with Internet access, reading material and food & beverages all day long – all of it free! So not only you save money, you get some privacy and exclusivity too.

– Discounts. You get discounts or promotional offers on restaurants, golf courses, spas and more.

– Complimentary Insurance & Card Protection. The bank or card issuer will provide air insurance cover. Citibank Premier Miles gets me Rs 1 Crore. Moreover, you will also be protected by card protection plan against any fraudulent purchases against your card.

– Other Offers. You may get invitation to several events like concerts or fashion shows, tickets to movies and shopping discounts and much more.

Now armed with this information, you too can avail these benefits and enjoy stress-free holidays in India and abroad. To help you narrow down your choice of a travel credit card, I have written another post on the top travel credit cards in India.

Do let me know your thoughts in the comments below.